Drowning in Dollars: How Free Market Principles Can Rescue Struggling Parents

Forget Government reports on what they define as "Inflation," pay more attention to Chapwood.

Last week in the echo chamber of social media, I ran across a Facebook post that depicted a parent forgoing lunches so kids don’t go hungry, whispering “maybe next time” through gritted teeth, all to keep the facade of stability. Sound familiar? It’s not just my story—it’s a chorus of quiet desperation. But here’s the hook: What if this isn’t inevitable? What if the real villain isn’t the corner store but a system stacked with interventions that stifle real relief? Let’s unpack how free market fixes could turn the tide.

What Many People Think

The echo chamber’s on full blast: Blame corporate greed for the grocery gouge, slap on price controls for gas, and pump out more subsidies to “help families cope.” With midterms heating up in 2025, pundits are doubling down—proposing everything from expanded food stamps to federal caps on “essential” pricing. It’s the easy sell: Government as the hero, stepping in to tame the wild market beast. Outlets like CNN and MSNBC are flooded with stories tying inflation to “profiteering,” ignoring how past bailouts and mandates fueled the fire. The narrative? More central planning will balance the scales. But as someone who’s bootstrapped through chronic conditions and economic dips, this doesn’t add up. Handouts feel good short-term, but they rarely build lasting boats.

What does Inflation look like in Reality

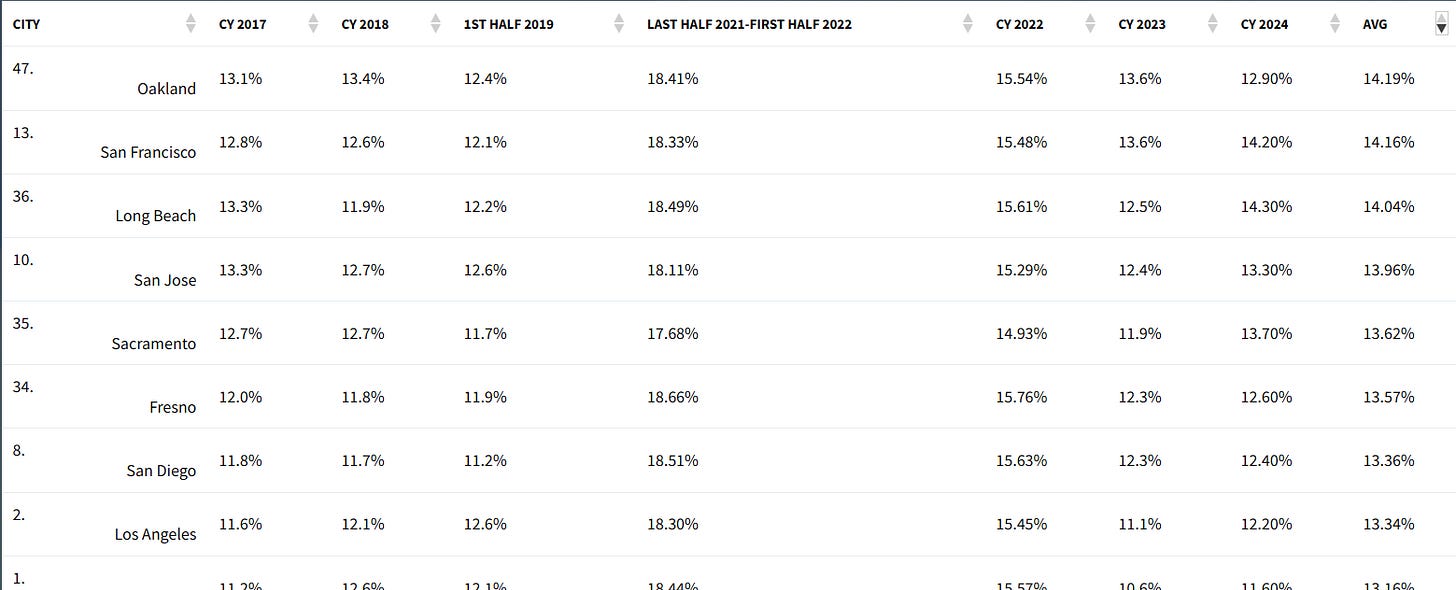

Forget the sanitized “official” government stats—let’s lean on the Chapwood Index, a no-BS measure of real after-tax spending on the 150 everyday items that hit families hardest. Unlike official numbers that seem plucked from thin air or the most important categories magically left out of the algorithm, Chapwood tracks actual price tags in America’s 50 biggest cities, twice a year, without the seasonal smoke and mirrors. Their latest drop for calendar year 2024 (released earlier this year) paints a brutal picture: Overall cost-of-living jumps averaging 11-14% across major metros, with no signs of cooling into 2025.

Take New York: 11.60% inflation in 2024, up from 10.6% in 2023. Los Angeles? 12.20%, edging past last year’s 11.1%. San Francisco tops the pain chart at 14.20%, while even more “affordable” spots like Houston clock 10.20%. These aren’t abstract; they’re your grocery cart, gas pump, and medicine cabinet exploding. Chapwood’s basket includes family staples like fast food, school supplies, pet food (because kids and chaos go hand-in-hand), and over-the-counter meds like Advil—stuff I pop for diabetic headaches that now costs an arm.

Pictured above is the Top 10 (sorted by Average) cities with the highest true cost-of-living increase in America. For parents, this means a 10-14% hit on essentials outpaces most wage bumps, turning “making ends meet” into a myth.

“The middle class can’t maintain their standard of living—their expenses outrun income every year.” - Ed Butowsky, Chapwood’s founder

In my Georgia neck of the woods (Atlanta’s at 10.60% for 2024), that translates to skipping family movie nights or piano lessons to cover rising cable and internet bills. It’s not laziness; it’s math that doesn’t add up.

And healthcare? Chapwood folds in costs like toothpaste and OTC drugs, but my insulin bills—tripled in a decade—mirror the trend. Families aren’t just tired; they’re treading water in a rising tide of untracked reality.

Chapwood’s History

To grasp why we’re gasping, rewind to the roots of this mess. The Chapwood Index kicked off in 2008 amid the financial meltdown, born from Butowsky’s frustration with “gimmicked” official data. But the real fracture? Nixon’s 1971 gold standard ditch, unleashing fiat money and inflation’s free-for-all. Fast-forward: The 2008 bailouts injected trillions, distorting markets and setting up shop for today’s distortions. COVID lockdowns? They snapped supply chains while stimulus floods (over $5 trillion) juiced demand without the goods—hello, 18% spikes in Chapwood’s 2021-2022 read (data gap in 2020, but the rebound was vicious).

Regulations layered on like wet cement. Energy mandates from the EPA choke drilling, inflating gas (a Chapwood staple) by limiting supply. Farm subsidies—$20 billion yearly—prop up big ag, warping food prices and hitting pizza nights and school lunches. A 2024 Heritage Foundation analysis (updated post-election) pegs federal regs at $2 trillion in annual business costs, funneled straight to your wallet. Historically, freer eras shone: Reagan’s 1980s dereg and tax cuts followed Volcker’s inflation smackdown, sparking a boom where Chapwood-like costs would’ve stabilized. Contrast the 1970s stagflation nightmare—cured not by more meddling, but market discipline.

As of October 10, 2025, with Fed rates hovering post-September’s cut to 4.75% and whispers of renewed tariffs under a divided Congress, we’re flirting with history’s rerun. Chapwood’s sustained 10%+ averages over eight years scream: Interventions don’t tame inflation; they breed it.

My unCommon Sense

Parents aren’t failing; the system’s interventions are, from money printers to red-tape empires. Ditch the crutches and unleash liberty. Correct the past’s fiat folly and enact free market principles now to empower families, not pacify them. Here’s the playbook:

Reclaim Sound Money: Audit the Fed, hard—better yet, phase toward asset-backed currency like gold to kill the inflation beast. Chapwood’s double-digit truths? Born from diluted dollars. I’ve hedged some with gold and other metals; families could too, shielding against 11% city bites. Historical nod: Pre-1971 gold eras kept costs near zero. Challenge the norm: Printing “stimulus” is theft from tomorrow’s lunchbox.

Unleash Energy and Food Markets: Axe EPA drilling bans—open federal lands, and gas (Chapwood-tracked) drops 20-30%, per energy wonks at the Cato Institute. Scrap $20B farm subsidies favoring corn kings over local growers; competition crashes grocery tabs. No more ethanol mandates turning your tank into a corn syrup slushie. In Atlanta’s 10.60% squeeze, that’s real snacks for school, not IOUs.

Tax Cuts and Entrepreneurial Fire: Slash income taxes—let parents keep 10-15% more to counter Chapwood’s creep. Echo the 1986 Tax Reform Act’s growth spurt. Repeal tariffs inflating everything from cars to car washes. Fewer biz licenses mean side hustles flourish—imagine moms baking “from nothing” dinners into micro-businesses. Liberty’s edge: Self-reliance beats subsidies.

Competition in Health and Essentials: My insulin? FDA delays and patent games jacked prices—streamline generics, allow imports, and watch costs plummet. Antitrust on Big Food/Pharma monopolies, not more regulations. Chapwood’s Advil and toothpaste hikes? Free entry fixes that… If markets worked like insulin approvals, bread would need a Rx—rising dough indeed!

This isn’t theory; it’s empowerment. Audit your own “Chapwood basket”—track those 150 items, vote with your wallet, and demand policies that trust you.

Wany to chat about this or anything else, let’s hash it over coffee or a craft brew—hit me up via email at dan@thrailkill.us or use the Message button below.

Have a good one,

Dan