The Ghost of the legal battle between Ford vs Dodge in 1919

How a 1919 Courtroom Brawl Still Bosses Around Companies in 2025

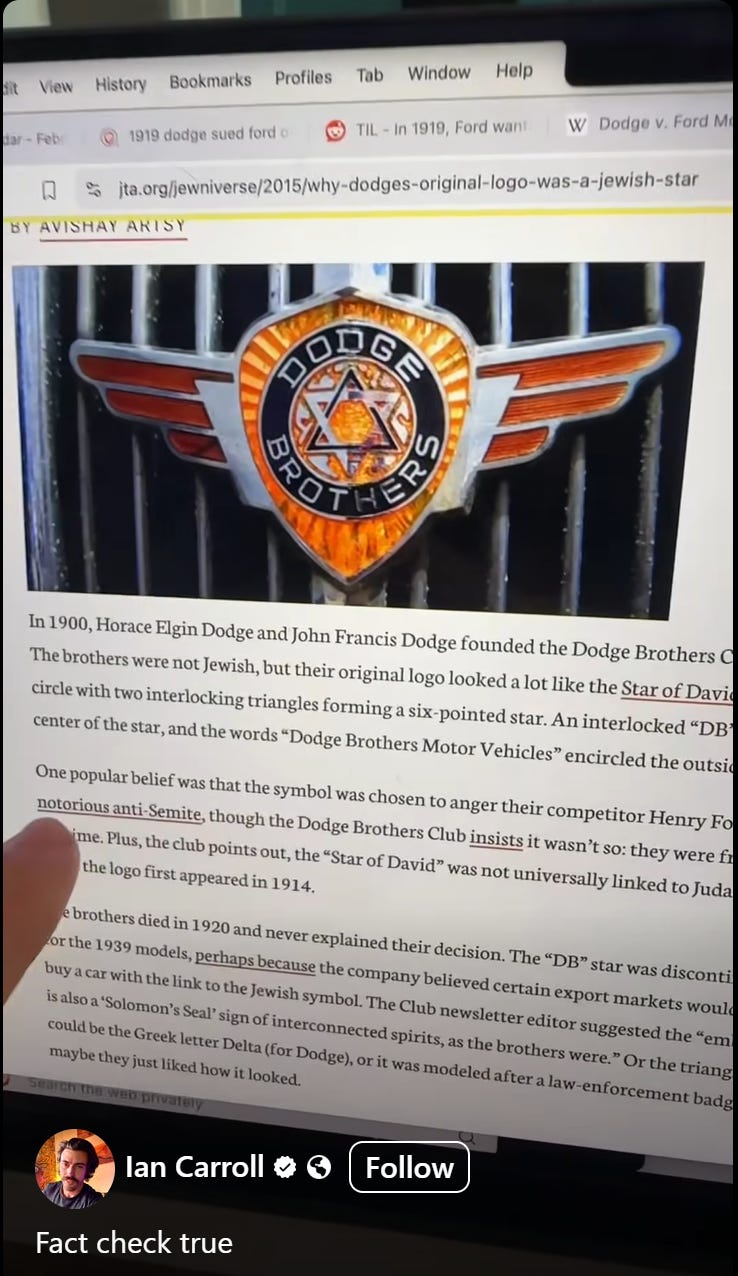

I am lucky to have a pretty diverse friend group both in person and online. Recently, a friend of mine sent me the following video and asked for my opinion. (click the image below to be taken to the video)

Until I saw this video, I’d never heard of the Ford vs Dodge case form 1919, but it made me want to learn more… so I asked Grok to tell me about it. This is what I got: Link to Grok explanation of Ford vs Dodge

As a guy who's spent years in HR and the economics of businesses, I've seen firsthand how old legal ghosts shape everything from corner-office decisions to the paycheck in your pocket. And with my own life—raising two amazing sons with my husband, navigating faith communities that sometimes feel as divided as that Michigan courtroom—I've got a soft spot for stories where personal values clash with the almighty dollar. So, let's dive into this bit of history and unpack why it's got everything to do with us in 2025.

The Backstory: A Brotherly Beef Turns into Corporate Gospel

Picture this: It's the early 1900s, and Henry Ford is revolutionizing the auto world. The man's a genius, cranking out Model Ts like nobody's business, making cars affordable for the average Joe. But here's the rub—Ford wasn't just in it for the cash. He believed in taking care of his workers, paying them a living wage so they could buy the very cars he built. In 1916, he decides to slash dividends to shareholders and plow the money into higher wages and even lower car prices. Noble, right? Well, not to the Dodge brothers, John and Horace, who held a chunk of Ford Motor Company stock. They were investors with a side hustle building their own cars, and they wanted their payout to fund that dream.

The Dodges sued, arguing Ford was running the company like a charity, not a profit machine. The Michigan Supreme Court sided with them in 1919, ruling that a business corporation's main gig is to make money for its shareholders. Directors, the court said, gotta operate with that in mind—can't just play Robin Hood with other people's investments.[1] Boom. That decision, Dodge v. Ford Motor Co., became the blueprint for "shareholder primacy." It's like the court handed down the Eleventh Commandment: Thou shalt maximize profits above all else.

Fast forward a bit, and irony alert—Ford bought out the Dodges later and kept doing his thing his way. But the legal precedent stuck like gum on a hot sidewalk.

How It's Still Calling the Shots in 2025

Now, let's fast-forward to today. That 1919 ruling? It's the North Star for corporate America, influencing everything from boardroom battles to Wall Street's wild ride. Think about it: In an era where we're wrestling with climate change, income inequality, and yeah, even health crises that hit folks like me with chronic conditions square in the wallet, companies are still legally bound to put shareholders first.

Take the push for ESG—Environmental, Social, and Governance investing. It's all the rage, with companies touting how they're going green or boosting diversity. But critics say it's just window dressing because Dodge v. Ford looms large, pressuring execs to deliver short-term gains over long-term good.[2] Remember the backlash against companies like Disney or Bud Light for wading into social issues? Shareholders cried foul, lawsuits flew, and suddenly, "woke capitalism" became a punchline. It's Dodge v. Ford's echo, reminding us that straying too far from the profit path can land you in hot water.

And it's not just big corps. Here in Cherokee County, small businesses like Mark's distillery feel the pinch. Investors—whether venture capitalists or local folks with a stake—want returns, so owners hesitate on community perks like sponsoring the county fair or offering flexible hours for parents. We've seen it with our school board debates too; when budgets get tight, it's "efficiency" over "equity," all under the guise of fiduciary duty to taxpayers as "shareholders."

Two Sides to the Coin: Scenarios That Make You Think

Before I drop my unCommon Sense on this, let's chew on a couple scenarios. First, imagine you're the CEO of a tech giant in 2025. AI's booming, but so is the call for ethical guardrails. Do you invest in pricey safety measures that might ding quarterly earnings, or pump up stock prices to keep investors smiling? Dodge says smile—profits first. We've seen giants like Meta or Google face shareholder suits for "wasting" money on philanthropy.

Flip it: You're an employee, maybe at a local manufacturer in Canton. Your company's eyeing offshoring to cut costs and boost dividends. Jobs vanish, families struggle—hello, opioid crisis in our neck of the woods. But hey, shareholders get richer. Or picture a pharma firm holding back on affordable insulin (don't get me started; as a Type 1 diabetic, I've ranted about this before). Why? Maximizing shareholder value means high prices, even if it squeezes everyday folks.

These aren't hypotheticals; they're ripped from headlines. And they pit individual liberty—my right to a fair wage, your right to breathe clean air—against institutional overreach disguised as "business as usual."

My unCommon Sense

Alright, here's where I plant my flag. That 1919 case? It made sense in a Gilded Age world of robber barons, but in 2025, it's as outdated as a flip phone. Companies aren't just money printers; they're woven into our communities, our lives. Shareholder primacy has fueled inequality wider than the Chattahoochee River—CEOs rake in millions while workers scrape by. We've got to evolve toward stakeholder capitalism, where employees, customers, and yes, even the planet, get a seat at the table.

Don't get me wrong; I'm all for personal responsibility and free markets. As a gay dad in a conservative county, I've fought for my slice of the American dream through hard work, not handouts. But forcing companies to ignore the greater good? That's not freedom; it's a straitjacket. Look at Patagonia or Ben & Jerry's—they balance profits with purpose and thrive. Or closer to home, Cherokee County businesses that invest in our kids' education or local health initiatives. That's unCommon Sense: Profit with a purpose builds stronger communities.

So, as we barrel into the rest of 2025, let's remember Ford vs. Dodge isn't ancient history—it's the rulebook we can rewrite. By demanding boards consider all stakeholders, we honor individual liberty while fostering the community values that make places like ours pretty damn awesome. Whether it's pushing for better corporate laws or supporting local spots that put people first, we've got the power.

If you want to chat about this or anything else, send me an email at dan@thrailkill.us, and let’s grab a coffee or a beer.

Have a good one,

Dan