The Government Shutdown Showdown: Why Increasing Healthcare Costs are less related to Tax Subsidies

When Americans face the true cost of healthcare, it will empower us all to make changes

Last week, my husband and I sat in our home office crunching numbers for the rest of this year and 2026, the news blared about the latest government shutdown drama. Democrats are framing it as a do-or-die battle over healthcare, warning that if Republicans don’t cave and extend those enhanced ACA subsidies in the budget bill, premiums will “skyrocket” come 2026. As someone who’s been buying my health insurance on the exchange for years as a self employed business owner, this is in my ballpark. I’ve dealt with skyrocketing costs before, like when I racked up credit card debt paying out-of-pocket for insulin without insurance coverage in the early to mid 2000s. Maybe the panic will translate into some reality. Facing the true cost of healthcare might actually empower us all to live healthier.

The Mainstream View

Flip on the news, and it’s all doom: Without extending the enhanced premium tax credits (PTCs) from the American Rescue Plan and Inflation Reduction Act—sunsetting December 31, 2025—ACA marketplace premiums will explode, leaving millions exposed. Democrats, leveraging the shutdown for leverage post-2024 midterms, spotlight Congressional Budget Office (CBO) projections: 2.2 million more uninsured in 2026 alone, swelling to 3.8 million yearly through 2034. For subsidized folks, out-of-pocket jumps could top 75% on average, per Peterson Health System Tracker analyses, with some families facing doublings from $3,576 to $6,490 annually.

These subsidies are the glue holding 22 million marketplace plans together. Let them lapse, and enrollment tanks, risk pools sour with sicker stay-behinds, and premiums spiral as healthier dropouts flee higher nets. Open enrollment hits November 1; delay action, and shoppers see sticker shock mid-signup. Compelling? Maybe. But it skips the causation: Those “skyrockets” are net costs unmasked, not gross premiums moon launching. As a guy who’s racked up credit card debt to buy insulin earlier in life, I value the buffer—but let’s not pretend it’s sustainable sleight-of-hand.

What the Data Really Shows

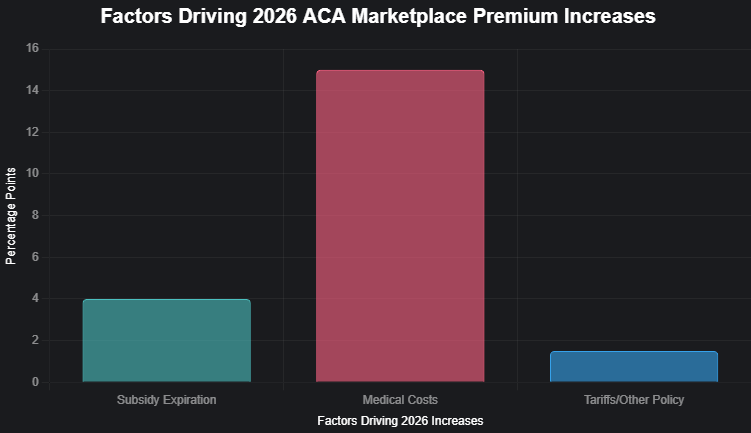

Gross premiums—the raw insurer ask before subsidies—increase. Peterson’s deep dive into 312 insurers’ filings across all states pegs the median 2026 hike at 18%, averaging 20%—steep vs. 2025’s 7%. Crucially, just 4 percentage points tie to sunsetting subsidies.

Endemic healthcare bloat:

Medical Inflation & Utilization: 14-16 points, with 8-9% trends from service hikes, labor crunches, and GLP-1 booms (Ozempic’s $1,000+ tabs per pop). Blue Cross filings blame provider consolidations squeezing reimbursements skyward.

Policy & External Pressures: 0-3 points from tariffs inflating drug/supply chains, plus Trump-era tweaks like the Marketplace Integrity rule upping income shares by 2.7%.

That 75%+ net sting? It’s subsidized wallets hitting full fare—e.g., a $70K family of four’s contribution leaping from 4.88% to 8.87% of income, adding $3,182 yearly, half from subsidy loss, half from underlying creeps. CBO tallies gross benchmarks up 7.9% average through 2034 sans extension, echoing pre-subsidy norms.

Historical Context

Rewind pre-Affordable Care Act (ACA): Premiums weren’t picnic baskets. From 2000-2010, family plans doubled, galloping 10-15% yearly on unchecked inflation—wages lagged, diabetics like me got denied or priced out. Individual rates up 147% from 2008-2017 amid ACA’s teething pains.

The launch of the ACA did not help. Mandates The ACA spiked costs by 24.4% over projections in 2014, $244 was the monthly premium average in 2013 and that doubled to $558 per month by 2019. The Government enacted enhanced subsidies to try and calm the storm and enrollment exploded from 11.4 million (2020) to 21.4 million (2024), but what happens when the tax payer funded cost cutting expires? The consumer faces the actual cost.

Today’s shutdown mirrors 2013’s ACA-fueled impasse: Uncertainty juiced rates then, now it’s happening again. Economist Jonathan Gruber said in 2017: “The individual market has always been volatile... premiums have been increasing steadily for years.” True then, truer now—subsidy veil or not.

My unCommon Sense

Amid the government shutdown grinding into its second week here on October 14, 2025, even Rep. Marjorie Taylor Greene (R)—a fellow Georgian who’s never shied from a fight—is carving her own lane on this ACA subsidy mess, breaking ranks with GOP brass to blast the impending premium doublings as “brutal” and a gut-punch to families like mine and hers. In a fiery post on X, she vented disgust at Republican leaders for fixating on “foreign countries and foreign wars” while ignoring how these expiring tax credits will hammer her own adult kids and Northwest Georgia constituents, calling the ACA a “disaster” and the insurance racket a “scam” but still floating openness to a bipartisan deal to avert the pain—earning a rare nod from Sen. Raphael Warnock (D), who quipped, “I never thought I’d say this, but Rep. Marjorie Taylor Greene is right.” Her rogue stance spotlights the subsidies’ sticky trap: They’ve dulled the blade of true costs, breeding complacency instead of the fierce market competition we need. Rather than double down on dependency, let’s heed her alarm as a call to action—strip the veil, unleash consumer power on providers and insurers, and build a system where self-reliant folks like us demand affordability through innovation, not endless bailouts.

This shutdown spectacle is fearmongering to prop a $335 billion decade-long deficit balloon (CBO’s permanent extension tab). I’m done with narratives that nanny us into complacency. Subsidies partially mask the beast: Providers merge monopolies, drugs like my insulin triple (2002-2013), and we foot indirect bills via taxes and government induced increased costs.

Let ‘em lapse! Unveil the true tab, and maybe, the market can actually dictate costs vs government entities. I’ve skipped flu jabs for years, never had the flu with the jab or without it; same ethos—own your risks, reap rewards. Short-term uninsured sting (2.2 million ‘26)? States like Vermont may buffer with local spending, but at the federal level, it’s moral hazard’s end.

Both parties feast on fright—Dems on dependency, GOP on cuts sans vision. True marketplace freedom? Interstate sales, tort reform, competition unchained, and less big government involvement. Until then, self-sovereign health: My insulin (I purchase outside of insurance because it’s cheaper), my plan, my power.

Dropping the crutch exposes the invoice we’ve co-signed, but ignites reforms: Transparency, rivalry, resilience. Your move: Subsidy savior or self-reliance rally? Drop a line—dan@thrailkill.us—and lets grab coffee or a beer and chat.

Have a good one,

Dan