The Slow Bleed: How the US Dollar Lost Over 97% of Its Value Since 1900

From wars and money printing to ditching gold—here’s why your dollar buys less every year, and what it means for everyday folks like me raising a family in Georgia.

A couple weeks ago, I was at the grocery store in Woodstock with my boys, picking up some Sports Drinks and Snacks for after one of their games. The total came to over $70 — stuff that probably cost my grandparents a few bucks back in the day. It got me thinking about how the US dollar has been quietly eroding for over a century, turning what was once a powerhouse currency into something that barely holds its ground against inflation. As a business owner and dad trying to build a secure future for my family, this isn’t just academic; it’s a wake-up call on why we can’t rely on fiat money alone.

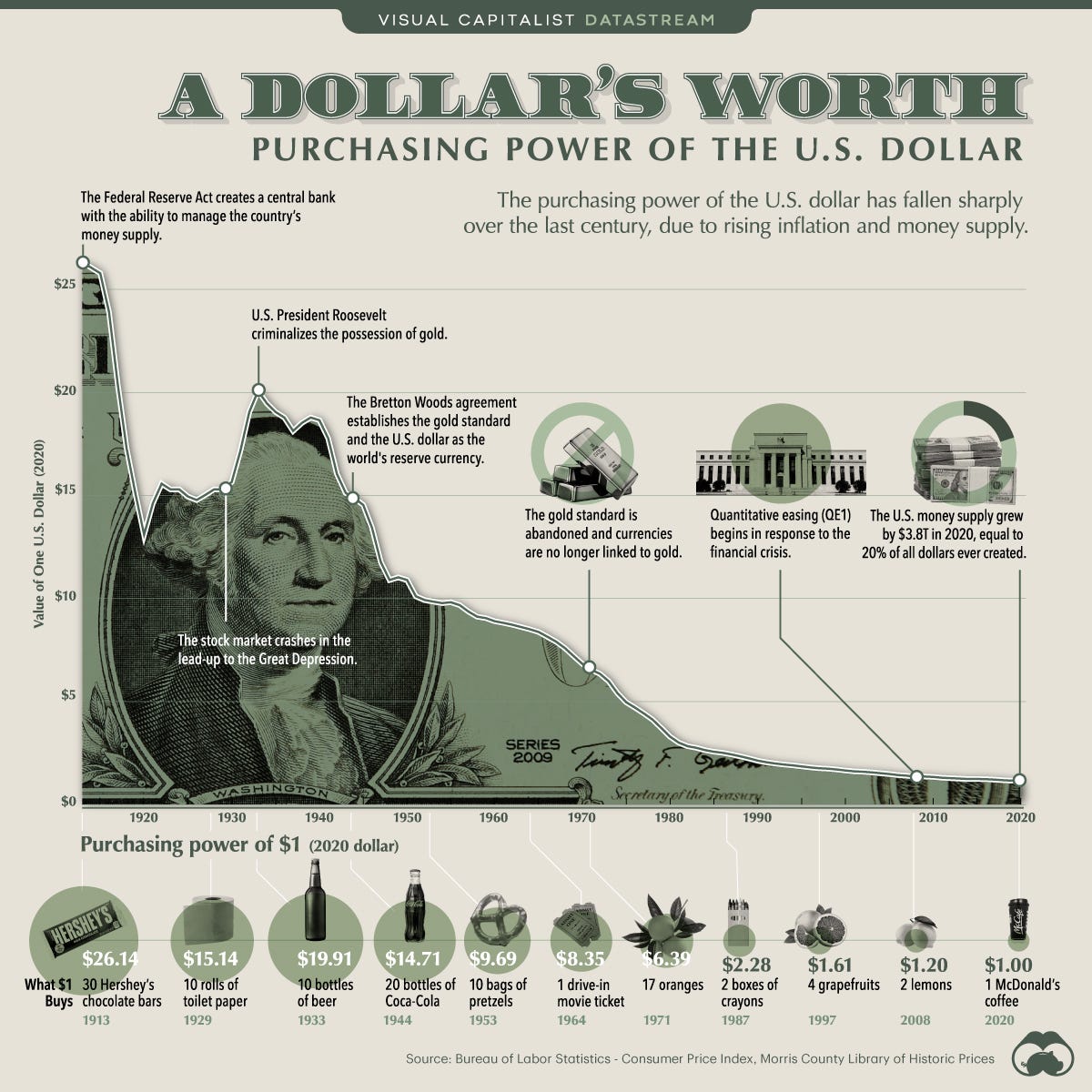

The US dollar’s devaluation since 1900 boils down to a steady loss of purchasing power, driven by economic policies, global events, and unchecked money creation. If you had $1 in 1900, it’d be worth about $0.03 today—a staggering 96.9% drop. Since 1913, when the Federal Reserve kicked in, the dollar has lost over 96% of its value, meaning $1 back then buys what about 4 cents does now. This isn’t some conspiracy; it’s the result of deliberate choices and crises. Let’s break down the main culprits, backed by the facts.

Inflation

Inflation is often mistaken for rising prices, but it’s really about the expansion (the inflating) of the money supply—more dollars chasing the same goods, diluting each dollar’s value. Think of it like watering down a drink; the Federal Reserve’s been pouring in new money, growing the M2 supply from $20 billion in 1913 to $21.4 trillion by 2023, with 20% of all dollars printed in 2020 alone for COVID relief. Rising prices are just the symptom or the side effect, not the cause. Defining inflation as price hikes confuses effect with cause and ignores other factors like supply shocks—say, the 2021 chip shortage jacking up car costs—that aren’t tied to money printing. As Milton Friedman said, “Inflation is always and everywhere a monetary phenomenon,” and that’s the real story behind why our dollars don’t stretch like they used to.

The Birth of the Federal Reserve: Unleashing the Money Printer (1913)

Before 1913, the dollar was tied to gold under the Gold Standard Act of 1900, which pegged it at about $20.67 per ounce of gold. That kept things stable—no endless printing. But the Federal Reserve Act of 1913 changed everything, creating a central bank to manage the money supply for “economic stability.” In reality, it opened the door to inflation by allowing more dollars to flood the system without backing.

The Fed’s early blunders, like tightening credit during the Great Depression, exacerbated deflation then, but over time, its policies fueled money growth. By expanding the money supply (M2) from $4.6 trillion in 2000 to $19.5 trillion in 2021, the Fed diluted the dollar’s value. Inflation has averaged about 3% annually since 1900, but that compounds: $100 in 1913 would cost over $3,000 today.

Wars and Massive Government Spending: Financing Chaos with Fresh Dollars

Wars have been a dollar-killer. World War I (1914-1918) led to temporary gold standard suspensions and gold outflows, devaluing the dollar against other currencies. World War II (1939-1945) boosted US reserves temporarily, but post-war spending kept the presses rolling.

The Vietnam War in the 1960s-1970s was a tipping point: unchecked spending, plus oil price spikes, caused inflation without cuts elsewhere, debasing the dollar. More recently, deficits from entitlements and crises like 2008’s financial meltdown and COVID-19 led to quantitative easing—printing trillions. In 2020 alone, 20% of all US dollars ($3.4 trillion) were created, slashing purchasing power further.

Ditching the Gold Standard: From Backed to Fiat (1933 and 1971)

The gold standard kept the dollar honest, but it got axed in stages. In 1933, amid the Depression, FDR’s Executive Order 6102 banned private gold ownership and devalued the dollar by 41%, setting gold at $35/ounce from $20.67. This was the first major devaluation, reducing the dollar’s gold value by 6% earlier in 1834, but 1933’s move was bigger.

The Bretton Woods Agreement in 1944 pegged the dollar to gold at $35/ounce, making it the world reserve currency. But by 1971, with deficits and overprinting, only 22% of dollars were gold-backed. Nixon’s “Shock” ended convertibility, turning the dollar fully fiat. Gold soared from $35/ounce in 1969 to $500 by 1980, showing the dollar’s plunge.

Economic Shocks and Policy Missteps: Oil, Deficits, and More

The 1970s oil embargoes spiked prices, fueling inflation. Persistent trade deficits and poor monetary policy have eroded confidence. Today, with mounting federal debt, critics warn of further devaluation through unsustainable spending.

The 2008 Financial Crisis: Fannie/Freddie Conservatorship and QE MBS Purchases

The 2008 housing crisis exposed massive risks in mortgage-backed securities (MBS), leading the government to place Fannie Mae and Freddie Mac—government-sponsored enterprises holding trillions in mortgage assets—into conservatorship under the FHFA. This involved Treasury injecting up to $200 billion in capital to stabilize them, effectively a bailout that increased public debt.

To further prop up the housing market and economy, the Fed launched quantitative easing (QE), purchasing $1.25 trillion in MBS during QE1 (2008-2010), and additional billions in later rounds like QE3 ($40 billion/month in MBS). These purchases created new money, ballooning the Fed's balance sheet from under $1 trillion pre-crisis to over $4 trillion by 2014, expanding the money supply (aka inflation). QE contributed to dollar devaluation by depreciating the currency—studies show Fed asset purchases led to a 5% effective dollar depreciation—and raising prices.

My unCommon Sense

Sure, living standards have risen despite the dollar’s decline—thanks to innovation and growth—but that doesn’t change the fact that fiat money is built to devalue over time under historical and current policies. For families like mine, it’s a reminder to diversify beyond dollars: think gold, real estate, or assets that hold value such as crypto.

If we, as a country, keep printing without restraint, we’re just kicking the can down the road.

If this sparks thoughts on inflation, investing, or how to protect your wallet, drop me an email at dan@thrailkill.us, click the Message Me button above, and let’s grab coffee or a beer. Always up for a real conversation.

Have a good one,

Dan